The Importance of Keeping Your Bike Insurance Up-to-Date: Lessons from Nikhil Kamath's Viral Incident

20 Aug 2024

20 Aug 2024 6 min read

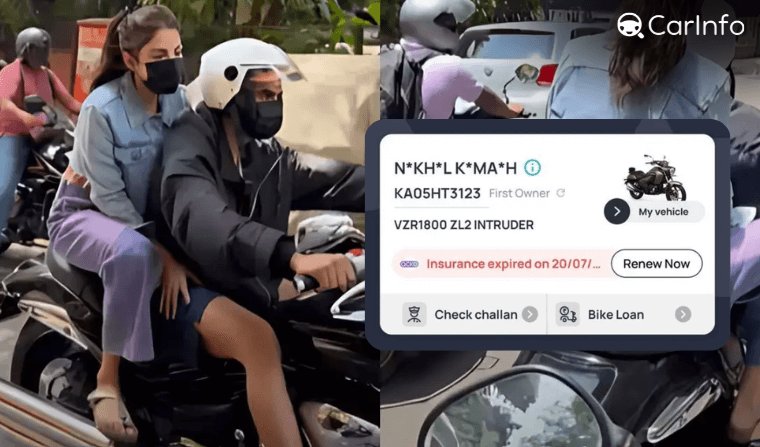

6 min readIn recent news, Nikhil Kamath, co-founder of Zerodha, found himself at the center of a social media storm when he was spotted riding his ₹18 lakh Suzuki Intruder VZR 1800 ZL2 motorcycle with expired insurance. The incident, which quickly went viral, highlights a critical aspect of vehicle ownership that many riders often overlook—keeping their bike insurance up-to-date.

While Kamath's lapse in renewing his insurance may have been an oversight, it serves as an important reminder for all two-wheeler owners. In this blog, we'll delve into the significance of maintaining valid bike insurance, the different types available, and how you can easily renew your policy online using platforms like Parivahan Sewa. We'll also discuss the implications of riding without insurance and provide tips on finding the best bike insurance for your needs.

Why Bike Insurance is Crucial

Bike insurance is not just a legal requirement in India; it is also a financial safety net that protects you from unforeseen expenses arising from accidents, theft, or damages. The Motor Vehicles Act mandates that every vehicle on the road must have at least a third-party insurance policy. This type of bike insurance, known as bike insurance third party, covers damages or injuries caused to a third party in an accident.

However, third-party insurance does not cover damages to your own vehicle. For comprehensive protection, you can opt for a comprehensive bike insurance policy that covers both third-party liabilities and damages to your own bike. Given the high cost of repairs and the rising number of accidents, having a comprehensive policy is often the wiser choice.

Know: A Comprehensive Guide to m Parivahan Sewa Services

The Consequences of Riding Without Insurance

As Nikhil Kamath's case illustrates, riding a bike without valid insurance can lead to legal troubles and financial losses. If caught by traffic authorities, you could face hefty fines and even legal action. Moreover, in the event of an accident, you would have to bear the entire cost of repairs and medical expenses out of pocket.

In addition to legal and financial risks, riding without insurance also puts you at a disadvantage in the event of theft or natural disasters. Imagine losing your expensive bike to theft or a flood and having no financial recourse. Insurance provides the peace of mind that, should the worst happen, you are financially protected.

Understanding Different Types of Bike Insurance

When it comes to insuring your two-wheeler, you have several options. Understanding these can help you choose the best coverage for your needs:

- Third-Party Insurance: As mentioned earlier, this is the most basic form of bike insurance and is mandatory by law. It covers any damage or injury you cause to a third party but does not cover damages to your own bike.

- Comprehensive Insurance: This policy offers broader coverage, including third-party liabilities as well as damages to your own bike due to accidents, theft, natural disasters, or fire. Comprehensive insurance is ideal for those who want complete protection for their two-wheeler.

- Standalone Own-Damage Insurance: If you already have third-party insurance but want additional coverage for your bike, you can opt for a standalone own-damage policy. This covers damages to your bike but not third-party liabilities.

- Long-Term Bike Insurance: Some insurers offer long-term bike insurance policies that provide coverage for two or three years, eliminating the need for annual renewals. This can be a convenient option if you prefer to avoid the hassle of yearly renewals.

- One-Year Bike Insurance: The most common type of policy, 1 year bike insurance price typically includes both third-party and own-damage coverage. It needs to be renewed annually, and the premium can vary based on factors like the bike’s make, model, and age.

Check: Mistakes to Avoid When Renewing Two-Wheeler Insurance

How to Renew Your Bike Insurance Online

Renewing your bike insurance has never been easier, thanks to online platforms like Parivahan Sewa. The process is quick, hassle-free, and can be done from the comfort of your home. Here's how you can renew your online bike insurance:

- Visit the Insurer’s Website: Most insurance companies offer online renewal services. Simply visit the insurer’s website, log in to your account, and choose the renewal option.

- Use Parivahan Sewa: The Parivahan Sewa portal, run by the Ministry of Road Transport and Highways, allows you to check and renew your vehicle insurance online. You can enter your vehicle’s registration number to view the insurance status and proceed with renewal if necessary.

- Compare Policies: Before renewing, take a moment to compare different policies. Use comparison websites to evaluate various online insurance bike renewal options based on coverage, premium, and additional benefits. This can help you find a policy that offers the best value for your money.

- Make the Payment: Once you’ve selected a policy, you can make the payment online using a credit card, debit card, or net banking. The new policy document will be sent to your email, and you can also download it from the insurer’s website.

Factors to Consider When Choosing Bike Insurance

When selecting or renewing your bike insurance, consider the following factors to ensure you get the best coverage:

- Coverage: Make sure the policy provides adequate coverage for both third-party liabilities and own-damage. If you have an expensive bike like Kamath’s Suzuki Intruder, comprehensive coverage is essential.

- Premium: The premium for two wheeler insurance can vary widely based on the bike’s make, model, age, and your location. Compare premiums from different insurers to find the most competitive rate.

- Claim Process: Check the insurer’s claim settlement ratio and read customer reviews to gauge how easy it is to file and settle a claim. A smooth and transparent claim process is crucial in times of need.

- Add-Ons: Many insurers offer add-ons like zero depreciation cover, engine protection, and roadside assistance. While these can increase the premium, they provide additional protection and peace of mind.

- No-Claim Bonus: If you haven’t made any claims during the policy term, you’re eligible for a no-claim bonus, which can significantly reduce your premium. Be sure to check if your insurer offers this benefit.

How CarInfo Can Help You Stay Updated

To make managing your bike insurance and other vehicle-related tasks easier, consider using the CarInfo app. CarInfo is your all-in-one solution for all your vehicle information needs. Whether you're looking to check your bike insurance status, renew your policy online, or even pay an e-challan, CarInfo has got you covered.

The app allows you to manage all your vehicles in one place, making it easier to keep track of important details like insurance renewals and RC details. You can also use CarInfo to check your car's service history, find information on RTO-related services, and trace car numbers with the owner's name. It's a convenient tool for any vehicle owner who wants to stay on top of their vehicle's maintenance and legal requirements.

By integrating tools like CarInfo into your routine, you can avoid the pitfalls that come with expired insurance and other lapses in vehicle maintenance. The app’s features are designed to help you navigate the complexities of vehicle ownership, ensuring that you remain compliant with all legal requirements while enjoying the benefits of a well-maintained vehicle.

Conclusion

Nikhil Kamath’s viral incident serves as a stark reminder of the importance of keeping your bike insurance up-to-date. Riding without insurance not only exposes you to legal and financial risks but also leaves you vulnerable to unforeseen events. Whether you own a luxury bike or a more modest two-wheeler, maintaining valid insurance is crucial for your safety and peace of mind.

By understanding the different types of bike insurance available and utilizing online platforms like Parivahan Sewa, you can easily renew your policy and ensure that your coverage is always current. Remember to compare policies, consider add-ons, and take advantage of no-claim bonuses to get the best value for your money.

So, don’t wait until it’s too late—check your bike insurance status today and renew it online to stay protected on the road. And to make this process even more convenient, download the CarInfo app and manage all your vehicle-related tasks in one place.

Featured Articles

Navigating Your Car Insurance Claim: A Step-by-Step Guide

Dealing with a car accident is never easy, but having a clear understanding of how to proceed with an insurance claim can make a significant difference. Whether you've experienced a minor scrape or a serious crash, following a structured process will help manage the situation more effectively. Here’s a thorough guide to help you file your car insurance [https://www.carinfo.app/car-insurance] claim step by step. Step 1: Prioritize Safety Immediately after the accident, your top priority should b

1 May 2024

1 May 2024 3 mins read

3 mins read

8 Tips to Get discounts on car insurance

Learn to maximize car insurance discounts without compromising coverage with our comprehensive guide.

19 Apr 2024

19 Apr 2024 4 mins read

4 mins read

Navigating Used Car Loans for First-Time Buyers

Purchasing your first car is an exciting milestone, but for many first-time buyers, the financial aspect can be daunting. Navigating used car loans involves understanding several key components, such as interest rates, loan terms, your credit score, and car insurance [https://www.carinfo.app/car-insurance?utm_medium=nav_bar]. This guide will provide you with essential information to make an informed decision and secure the best possible loan for your needs. Understanding Used Car Loans A used c

3 Jun 2024

3 Jun 2024 4 mins read

4 mins read

Is the Maruti Suzuki Grand Vitara Safe? Unveiling Its Latest Safety Ratings

As the automotive landscape continues to evolve, safety remains a paramount concern for car buyers, particularly in India. The Maruti Suzuki Grand Vitara, a product of the Maruti and Toyota joint venture, has emerged as a significant contender in the SUV market dominated by the likes of Hyundai Creta and Kia Seltos. But how does it stack up in terms of safety? Let's delve into the details of the Grand Vitara's safety features, awaited ratings, and the implications for those looking to buy a car

7 May 2024

7 May 2024 3 mins read

3 mins read

Top 5 Cheapest Electric Cars in India: 2024 Edition

As the world progressively shifts towards sustainable mobility, India is not far behind, experiencing a significant uptake in electric vehicles (EVs). This shift is propelled by both governmental incentives and the innate cost-effectiveness of EVs compared to traditional internal combustion engine (ICE) vehicles. However, the adoption of EVs in India faces challenges such as range anxiety and the limited availability of charging stations. To aid potential buyers, this blog post highlights the fi

1 May 2024

1 May 2024 3 mins read

3 mins read

Ford Endeavour 2024: Price, Launch Date & Specs in India

Prepare for the awesome launch of Ford Endeavour 2024 in India! Discover its price specs & even more. Boost your SUV experience today!

17 Apr 2024

17 Apr 2024 2 mins read

2 mins read

Hyundai Brings Back Grand i10 Nios Corporate Variant

Hyundai recently introduced the Grand i10 Nios Corporate variant, available at a price range of Rs 6.93 lakh to Rs 7.58 lakh (ex-showroom, Delhi). This variant, named similarly to a limited edition previously launched in 2020 but discontinued in 2021, comes with both manual and AMT options, powered by the familiar 83hp, 1.2-liter petrol engine. Priced slightly higher than the Magna trim by Rs 15,000, yet notably more affordable than the Sportz Executive by Rs 35,000, the Nios Corporate variant

12 Apr 2024

12 Apr 2024 1 mins read

1 mins read

Noida police to cancel Driving License. Know why

In a bid to enhance road safety and discipline among drivers, the Noida Police in Gautam Buddh Nagar has recently issued a stern warning that accumulating more than three consecutive traffic rule violation challans could lead to the cancellation of driving licenses. This move comes in accordance with the directives outlined by the Supreme Court Committee on Road Safety and decisions made during the Uttar Pradesh Road Safety Council meeting. The police have specifically identified offenses such

13 Dec 2023

13 Dec 2023 2 mins read

2 mins read

Everything you need to know about Ather 450S

On September 11th, Ather has started delivery of their newest model, 450S. The company also introduced some exciting features ahead of this launch. It comes with a latest capacity of of 2.9 kWh with a range of about 115 miles. Along with a top speed of 90 km/h, it accelerates from 0 to 40 km/h in just 3.9 seconds. It is the most affordable model in the Ather line, and it is offered at a competitive price of Rs 1,29,999. It comes in a variety of colours, including cosmic black, still white, s

12 Sep 2023

12 Sep 2023 1 mins read

1 mins read

Tata-AIG Launches Usage-Based Car Insurance Policy

Tata-AIG has launched the new usage-based car insurance policy. Along with that, the insurance company has rolled out a new telematics-based application and device ‘AutoSafe’. The policy is designed to enable policyholders save more money on their premium by paying only for the kilometres that they drive. About the AutoSafe Solution Tata-AIG came up with this pay-as-you-drive solution under the IRDAI Regulatory body with a joint venture of and US-based American International Group (AIG). Its A

16 Jul 2020

16 Jul 2020 2 mins read

2 mins read

Navigating Your Car Insurance Claim: A Step-by-Step Guide

Dealing with a car accident is never easy, but having a clear understanding of how to proceed with an insurance claim can make a significant difference. Whether you've experienced a minor scrape or a serious crash, following a structured process will help manage the situation more effectively. Here’s a thorough guide to help you file your car insurance [https://www.carinfo.app/car-insurance] claim step by step. Step 1: Prioritize Safety Immediately after the accident, your top priority should b

1 May 2024

1 May 2024 3 mins read

3 mins read

8 Tips to Get discounts on car insurance

Learn to maximize car insurance discounts without compromising coverage with our comprehensive guide.

19 Apr 2024

19 Apr 2024 4 mins read

4 mins read

Navigating Used Car Loans for First-Time Buyers

Purchasing your first car is an exciting milestone, but for many first-time buyers, the financial aspect can be daunting. Navigating used car loans involves understanding several key components, such as interest rates, loan terms, your credit score, and car insurance [https://www.carinfo.app/car-insurance?utm_medium=nav_bar]. This guide will provide you with essential information to make an informed decision and secure the best possible loan for your needs. Understanding Used Car Loans A used c

3 Jun 2024

3 Jun 2024 4 mins read

4 mins read

Is the Maruti Suzuki Grand Vitara Safe? Unveiling Its Latest Safety Ratings

As the automotive landscape continues to evolve, safety remains a paramount concern for car buyers, particularly in India. The Maruti Suzuki Grand Vitara, a product of the Maruti and Toyota joint venture, has emerged as a significant contender in the SUV market dominated by the likes of Hyundai Creta and Kia Seltos. But how does it stack up in terms of safety? Let's delve into the details of the Grand Vitara's safety features, awaited ratings, and the implications for those looking to buy a car

7 May 2024

7 May 2024 3 mins read

3 mins read

Top 5 Cheapest Electric Cars in India: 2024 Edition

As the world progressively shifts towards sustainable mobility, India is not far behind, experiencing a significant uptake in electric vehicles (EVs). This shift is propelled by both governmental incentives and the innate cost-effectiveness of EVs compared to traditional internal combustion engine (ICE) vehicles. However, the adoption of EVs in India faces challenges such as range anxiety and the limited availability of charging stations. To aid potential buyers, this blog post highlights the fi

1 May 2024

1 May 2024 3 mins read

3 mins read

Ford Endeavour 2024: Price, Launch Date & Specs in India

Prepare for the awesome launch of Ford Endeavour 2024 in India! Discover its price specs & even more. Boost your SUV experience today!

17 Apr 2024

17 Apr 2024 2 mins read

2 mins read

Hyundai Brings Back Grand i10 Nios Corporate Variant

Hyundai recently introduced the Grand i10 Nios Corporate variant, available at a price range of Rs 6.93 lakh to Rs 7.58 lakh (ex-showroom, Delhi). This variant, named similarly to a limited edition previously launched in 2020 but discontinued in 2021, comes with both manual and AMT options, powered by the familiar 83hp, 1.2-liter petrol engine. Priced slightly higher than the Magna trim by Rs 15,000, yet notably more affordable than the Sportz Executive by Rs 35,000, the Nios Corporate variant

12 Apr 2024

12 Apr 2024 1 mins read

1 mins read

Noida police to cancel Driving License. Know why

In a bid to enhance road safety and discipline among drivers, the Noida Police in Gautam Buddh Nagar has recently issued a stern warning that accumulating more than three consecutive traffic rule violation challans could lead to the cancellation of driving licenses. This move comes in accordance with the directives outlined by the Supreme Court Committee on Road Safety and decisions made during the Uttar Pradesh Road Safety Council meeting. The police have specifically identified offenses such

13 Dec 2023

13 Dec 2023 2 mins read

2 mins read

Everything you need to know about Ather 450S

On September 11th, Ather has started delivery of their newest model, 450S. The company also introduced some exciting features ahead of this launch. It comes with a latest capacity of of 2.9 kWh with a range of about 115 miles. Along with a top speed of 90 km/h, it accelerates from 0 to 40 km/h in just 3.9 seconds. It is the most affordable model in the Ather line, and it is offered at a competitive price of Rs 1,29,999. It comes in a variety of colours, including cosmic black, still white, s

12 Sep 2023

12 Sep 2023 1 mins read

1 mins read

Tata-AIG Launches Usage-Based Car Insurance Policy

Tata-AIG has launched the new usage-based car insurance policy. Along with that, the insurance company has rolled out a new telematics-based application and device ‘AutoSafe’. The policy is designed to enable policyholders save more money on their premium by paying only for the kilometres that they drive. About the AutoSafe Solution Tata-AIG came up with this pay-as-you-drive solution under the IRDAI Regulatory body with a joint venture of and US-based American International Group (AIG). Its A

16 Jul 2020

16 Jul 2020 2 mins read

2 mins readCarInfo is your all-in-one app for all your vehicle info needs and RTO vehicle information. Now manage all your vehicles in one place. Trace your car number with owner name

ISO 27001:2022 Certified